Use our forex calculator to calculate margin, Please ensure you fully understand the risks and take appropriate care to manage your risk. Forex Calculator Streamline your trading process by using our epic forex calculators 2/16/ · Forex risk management, what does it really mean? Risk management is the ability to contain your losses so you don’t lose your entire capital. It’s a technique that applies to anything involving probabilities like Poker, Blackjack, Horse betting, Sports betting and blogger.comted Reading Time: 6 mins 6/14/ · Learn how professional traders use the Forex position size calculator to implement sound risk management strategies. How to calculate position size Forex is critical to accurately manage your risk. In this guide, we’re going to show you how to use our proprietary Forex position size calculator so you can work out your trading position sizes whenever you need blogger.comted Reading Time: 7 mins

Forex Risk Management Calculator • How to Calculate Lot Size

Add the following code to your website to display the widget. You may override the default styles with your own. Check out the live price action of this pair with our Live Price Charts.

Use our Position Size and Risk Calculator to easily calculate the recommended lot size, using live market quotes, account equity, risk percentage and stop loss.

In forex a Lot defines the trade size, or the number of currency units to be bought or sold in a trade. One Standard Lot isunderstand risk management forex calculator, units of the base currency. Most brokers allow trading with fractional lot sizes down to.

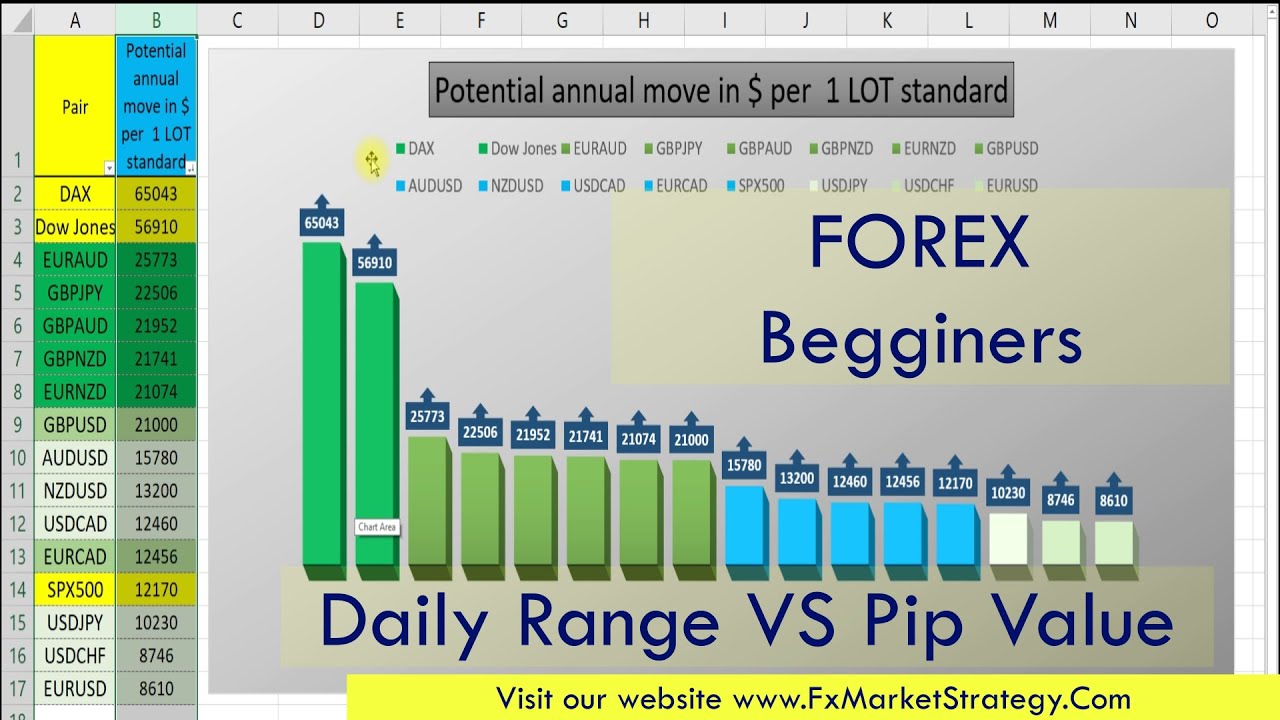

Fractional lot sizes understand risk management forex calculator sometimes referred to as mini lots, micro lots and nano lots. Please refer to the image above to compare the sizes and units.

Deposit currency: The account base currency is important to assess the ideal lot size, as it takes into consideration the pip value and the market rate of the selected cross.

We choose USD as our deposit currency, understand risk management forex calculator, for this example. Stop loss pips : Traders should input the maximum number of pips they are willing to risk, or lose, in a trade, to protect the account equity in case the market goes against their position.

For this example we will use pips as our stop loss. Account balance: Pretty straight forward, understand risk management forex calculator, traders just need to input their account equity. On our example we will type Risk: The crucial field of this Position Size and Risk Calculator! This technique will allow for traders to last longer with their trading careers, and eventually, also to recoup from previously losing trades, understand risk management forex calculator.

Now, we hit the "Calculate" button. Next, the calculator displays the amount of units that 0. You might also find our Drawdown Calculator useful. It can help you to accurately calculate how your trading account equity can be affected after a series of losing trades. Our tools and calculators are developed and built to help the trading community to better understand the particulars that can affect their account balance and to help them on their overall trading.

Regardless if investors trade the Forex market, cryptocurrencies or any other financial instruments, our complete suite of accurate Forex tools and calculators are programmed to work with any data inputted. By using live market data, our set of calculators allows traders to always get understand risk management forex calculator most accurate results possible, and they work with most FX pairs, metals and even cryptocurrencies. Also, these great calculators are translated into 23 different languages including Arabic, Russian, Japanese and Chinese.

With an intuitive design and a user-friendly interface, these calculators can be easily integrated with any web page. The substantial understand risk management forex calculator is that they are completely unbranded, and can be fully customizable to any color scheme and to fit the layout of any web page.

Tools Menu Position Size Calculator Calculate Lots, Risk, Units, Stop Loss Add the following code to your website to display the widget. You may override the default styles with your own Click here to set your own styles Top pane styles background: white; border: solid 1px black; border-bottom: none; color: black. Bottom pane styles background: white; border: solid 1px black; color: black. Button styles background: black; color: white; border-radius: 20px.

Preview Reset. Display tool title. Show chart links. Language Browser language Page language Čeština Deutsch English Español Filipino Français Hrvatski Indonesia Italiano Magyar Polski Português Română Tiếng Việt Türkçe Ελληνικά Български русский العربية فارسی ไทย 中文 한국어 日本語. Deposit currency AUD BCH BTC CAD CHF CNH CNY CZK DKK DOGE Understand risk management forex calculator EOS ETH EUR GBP HKD HUF ILS INR JPY LTC MXN NOK NZD PLN RON RUB SEK SGD THB TRY USD XAG XAU XLM XRP ZAR.

Open price You must enter a valid number. Stop loss pips You understand risk management forex calculator enter a valid number. Account Balance You must enter a valid number. EURUSD 1 Pip Size. EURUSD Price. Lots trade size Units trade size Money at risk View EURUSD Live Chart View EURUSD Historical Chart.

Switch to stop loss price. Forex pairs areunits per 1 lot Units per 1 lot vary on non-forex pairs, please check with your broker In MT4 and MT5 right click a symbol and then click Specification.

The Contract Size field tells how many units are in one lot. View image. Is this article helpful? Share it with a friend HTML Comment Box is loading comments Share this page using your affiliate referral link Forex Calculators. Pip Calculator. Forex Rebates Calculator. Profit Calculator. Compounding Calculator. Drawdown Calculator.

Risk of Ruin Calculator, understand risk management forex calculator. Pivot Point Calculator. Fibonacci Calculator. Margin Calculator. Currency Converter. Trading Tools. Live Charts. Forex Economic Calendar. Broker Spreads Comparison Tool. Broker Swaps Comparison Tool. Academy Home. Forex Widgets. Forex Calculators. Sign Up. Remember Me. Join our mailing list? Forgotten Password.

Best Risk Calculator For Meta Trader 4 And Meta Trader 5 -��

, time: 12:43Position Size Calculator - blogger.com

The results: The Position Size and Risk Calculator uses a market price live feed with the current interbank rate (in a 5-digit format) and it will display the selected currency pair price (in our example the USD/CAD price). In this case, using a stop loss of pips and risking 2% of our account equity, the recommended lot size would be lot Forex Risk Management – How to calculate the correct lot size in forex trading. Forex Risk Management And you will need to know how to calculate the right risk % per trade. As mentioned in part 1 of the series of forex risk management. The safe risk percentage per trade is from 1% – 3%. And in this part 2 series Micro lots. This means that in order to abide by money management rules, you shouldn't open more lots than recommended above. At the same time, no need to open the maximum number of lots available. Stay within the comfortable limit. 1 Standard lot = units. 1 Mini lot = 10 units (or standard lots) 1 Micro lot = units (or 0

No comments:

Post a Comment