rows · One micro-lot is a hundredth of a standard lot, or 1, units of a currency. Despite its 4/6/ · Micro Lot Definition Novice or introductory traders can use micro-lots, a contract for 1, units of a base currency, to minimize and/or fine-tune their position size. more 12/5/ · In the example above, the broker required a 1% margin. This means that for every $, traded, the broker wants $1, as a deposit on the position. Let’s say you want to buy 1 standard lot (,) of USD/JPY. If your account is allowed leverage, you will have to put up $1, as margin. The $1, is NOT a fee, it’s a blogger.comted Reading Time: 5 mins

Your Guide to Forex Lot Sizes: Mini, Micro, and Standard Lot - Pro Trading School

John Russell is an experienced point 1 currency micro lot in forex developer who has written about domestic and foreign markets and forex trading for The Balance. He has a background in management consulting, database and administration, and website planning. Today, he is the owner and lead developer of development agency JS Web Solutions, which provides custom web design and web hosting for small businesses and professionals. When you first get your feet wet with forex trainingyou'll learn about trading lots.

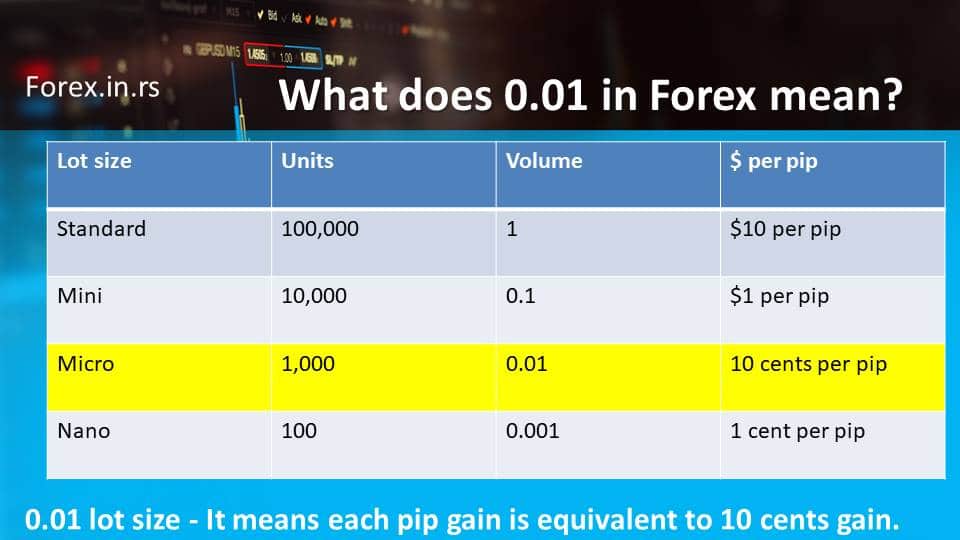

In the context of forex trading, a lot refers to a batch of currency the trader controls. The lot size is variable. Typical designations for lot size include standard lots, mini lots, and micro lots.

It is important to note that the lot size directly impacts and indicates the amount of risk you're taking. Finding the best lot size with a tool like a risk management calculator or something similar with a desired output point 1 currency micro lot in forex help you determine the best lot size based on your current trading account assets, whether you're making a practice trade or trading live, as well as help you understand the amount you would like to risk.

The trading lot size directly impacts how much a market move affects your accounts. For example, a pip move on a small trade will not be felt nearly as much as the same pip move on a very large trade size. You will come across different lot sizes in your trading career, and they can be explained with the help of a useful analogy borrowed from one of the most respected books in the trading business.

Micro lots are the smallest tradeable lot available to most brokers. A micro lot is a lot of 1, units of your account funding currency, point 1 currency micro lot in forex.

If your account is funded in U. If you are trading a dollar-based pair, 1 pip would be equal to 10 cents. Before micro-lots, there were mini lots. A mini lot is 10, units of your account funding currency. If you are a beginner and you want to start trading using mini lots, make sure that you're well-capitalized. It's up to you to decide your ultimate risk tolerance. A standard lot is a ,unit lot.

So most retail traders with small accounts don't trade in standard lots. Most forex traders that you come across are going to be trading mini lots or micro-lots.

It might not feel glamorous, but keeping your lot size within reason relative to your account size will help you preserve your trading capital to continue trading for the long term. If you have had the pleasure of reading Mark Douglas' Trading In The Zonepoint 1 currency micro lot in forex, you may remember the analogy he provides to traders he has coached, which he shares in the book.

In short, Douglas recommends likening the lot size that you trade and how market moves would affect you, to the amount of support you have under you while walking over a valley when something unexpected happens. To illustrate this example, a very small trade size relative to your account capital would be like walking over a valley on a very wide, stable bridge where little would disturb you even if there was a storm or heavy rains.

Now imagine that the larger the trade you place the smaller and riskier the support or bridge under you becomes. When you place an extremely large trade size relative to your account balance, the bridge gets as narrow as a tightrope wire, point 1 currency micro lot in forex, such that any small movement in the market would be like a gust of wind in the example, and could send a trader the point of no return.

Trading Forex Trading. By Full Bio Follow Linkedin. Follow Twitter. Read The Balance's editorial policies. Reviewed by. Full Bio Follow Linkedin. Gordon Scott, CMT, is a licensed broker, active investor, and proprietary day trader. He has provided education to individual traders and investors for over 20 years. He formerly served as the Managing Director point 1 currency micro lot in forex the CMT® Program for the CMT Association.

Article Reviewed on May 22, Read The Balance's Financial Review Board. Article Sources.

How to calculate lot Sizes

, time: 4:56Forex Lot Sizes: Micro, Mini, and Standard Lots Explained - Forex Training Group

For example, the lot denomination currency would be Euros for the EUR/USD currency pair or U.S. Dollars for the USD/JPY currency pair. Typical Sized Lots in Forex Trading Available at Online Forex Brokers. In the online forex market, the trading lot size offered by brokers can vary considerably, so retail clients enjoy a greater degree of choice in their minimum trading amounts. Furthermore, saying that you are “trading a 1 lot in forex currency Estimated Reading Time: 12 mins 4/6/ · Micro Lot Definition Novice or introductory traders can use micro-lots, a contract for 1, units of a base currency, to minimize and/or fine-tune their position size. more rows · One micro-lot is a hundredth of a standard lot, or 1, units of a currency. Despite its

No comments:

Post a Comment