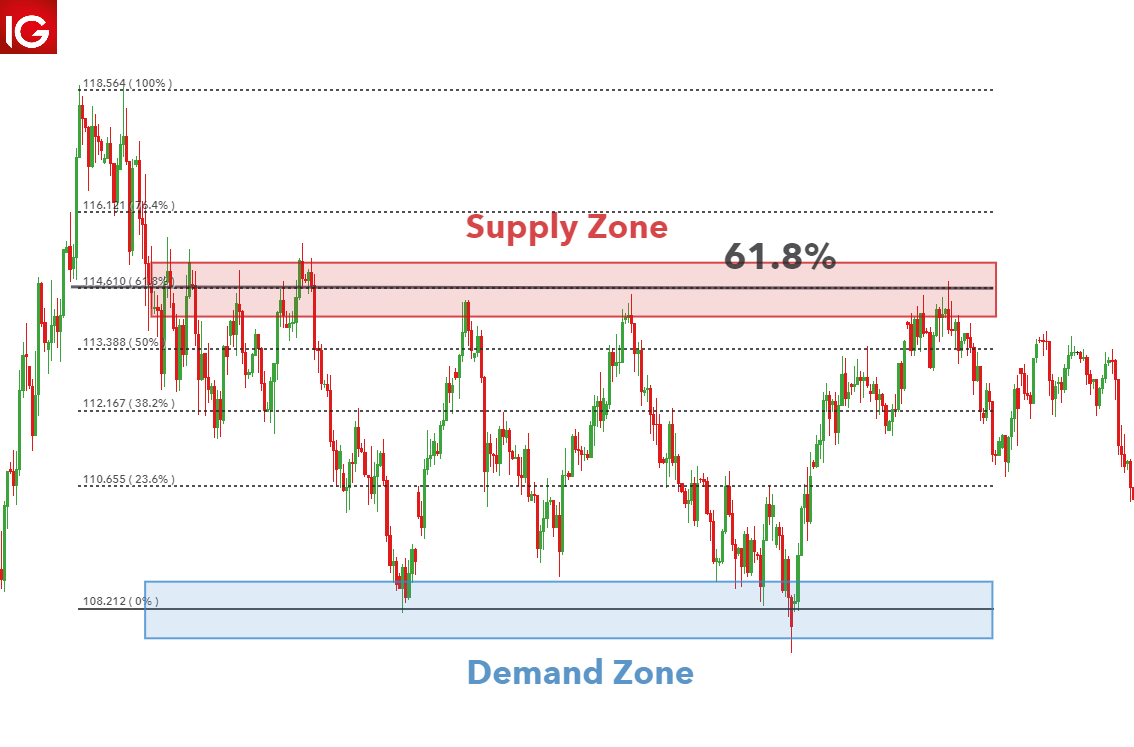

A supply and demand based trading system is a relatively simple, yet powerful way to trade Forex. It is considered one of the purest price action trading mythologies around. The rules of supply and demand analysis in Forex are quite simple. You should buy when the price action approaches a demand level and bounces blogger.comted Reading Time: 8 mins Nov 12, · Over the past few years a new type of trading method has become widely popular with forex traders. Supply and demand trading is a trading method where the idea is to find points in the market where the price has made a strong advance or decline and mark these areas as supply and demand zones using rectangles.. The point in which the price has made a strong advance is marked Estimated Reading Time: 14 mins The area between the shadow CS and the supply or demand zone (opening of the DM) is called the "light tunnel" is should be between pips. This is the "Sharp Entry Point". The supply or demand zone can become smaller by focusing on smaller TF as low as 5 Mins. 1 Min is not blogger.com Size: 1MB

Forex Trader's Guide to Supply and Demand Trading - Forex Training Group

Multiple timeframes analysis, one of the most complex ways to look at markets, has never been easier. Back in the day, traders tracked charts using pen and paper. While an accurate method, it involved plenty of time and resources wasted. A complete multiple timeframes analysis in Forex trading always starts with the bigger timeframe first.

Such an approach has multiple advantages, but the main one is that it offers a clear picture of the market. I will provide a plenty of reasons to support it. Swing traders enjoy the hourly and four-hour timeframes setups.

And, investors keep an eye on the bigger timeframes. Or, why not trade different styles on different trading accounts? Finally, a multiple timeframes analysis keeps the trader on the right side of the market.

It also does filter the noise on the lower timeframes. With this article, my aim is forex trading supply and demand marking timeframe introduce the power of using a multiple timeframes analysis in your trading.

A warning from the start: it is a complex but rewarding process for the dedicated trader! As a price action tradermultiple timeframe analysis fits my trading style perfectly. By offering an unbiased, overall picture, it builds an equilibrium point between different time perspectives. Like it or not, timeframes have different importance in the day-to-day market analysis, forex trading supply and demand marking timeframe. For instance, what is the one-minute chart telling you?

Or, more precisely: does it offer meaningful forex trading supply and demand marking timeframe The MT4 or the MetaTrader4 platform comes with the following standard timeframes by default:.

All of them are important for different stages of a multiple timeframes analysis. However, depending on the trading platform, traders have access to other timeframes too.

For instance, forex trading supply and demand marking timeframe, the M2 two-minute chart or H2 two-hour chart exist, and some traders use them when doing technical analysis. As always, keeping things simple helps. Therefore, scalpers value highly this information in their trading strategy.

At best, traders use it for scalping their way during illiquid trading sessions. Asian traders love it. Because the Forex market stands still most of the Asian sessions, forex trading supply and demand marking timeframe, traders active during the Asian session have a hard time catching swing trades.

As such, they move to the lower timeframes like M1 and use oscillators to buy the lows and sell the highs of the session. As such, traders using M1 most of the times end up wasting both precious time and resources trading on a dangerous timeframes.

That is if trading is manual or with Expert Advisors. Quant firms love such timeframes. In fact, they go even below M1, forex trading supply and demand marking timeframe, trading for the 7 th8 th or even 9 th decimal of a quote. But again, from a multiple timeframes analysis, M1 is useless for the inexperienced.

As, in fact, are all other timeframes that start with the letter M. They all share the same risk and provide little or no information as to where the market actually goes. Hence, a multiple timeframes analysis starts at the H1 chart. Perhaps you all wonder why multiple timeframes analysis stops at the H1 chart and not starting with it.

The answer is that a true multiple timeframes analysis is a top-bottom, forex trading supply and demand marking timeframe a bottom-up analysis.

As such, it begins with the highest timeframes possible ideally multi-year charts and goes lower to the smaller ones. And yes, it preferably stops at the hourly chart. Coming back to the H1 chart, it is one of the most important timeframes of them all. The answer comes from its simplicity, as brokers cannot alter that much the information provided.

Let me explain why in more details. Broker houses around the world have their servers placed in various locations. Cost considerations make a broker from the Forex trading supply and demand marking timeframe Kingdom to place the servers in Ukraine, for instance, or one from the United States to have their servers in Asia. Because of that, the charts show different information on almost all bigger timeframes. Candlesticks simply start at different times. The two hours difference between the two physical locations will reflect differently in a four-hour chart.

The same holds true with a daily chart: the daily candlestick starts and closes with a lag of two hours. Imagine you trade simply from a technical analysis perspective. As such, opening and closing prices are vital.

With different information on different brokers, different results appear. Hence, one winning strategy on one broker might prove disastrous on another. An hour is an hour around the globe: it starts at the top of the hour and sixty-minute later the candlestick closes.

Believe it or not, brokers use various tricks to alter the information, so they get an edge from everything possible, forex trading supply and demand marking timeframe. The solution to the problem listed above is to use the same server time on all of your analysis. Simply ask the broker to provide you with the right charting info. For instance, the best charting info comes from the GMT timeframe.

Pure and simple, the GMT pricing is the unaltered one. Now, go try to find a broker listing GMT prices. The H4 on a GMT pricing shows one crucial piece of information: the daily, weekly, and monthly fixings. For those not familiar with the concept, every four-hour during the day the clearing on futures markets result in a rise in volatility on the spot market. Moreover, forex trading supply and demand marking timeframe, it is even more important when it comes at the end of the trading week.

Furthermore, it is vital at the end of the trading month. The key is to sit with institutional players, their interest, and focus. And that info is better seen on the H4 chart. With, obviously, one condition: GMT prices.

I would always prefer the info provided by the daily chart than any other timeframe. Perhaps only the H4 during fixing times is equally as important as the daily chart. That is, again, if you use GMT prices. The closing of such candlesticks is crucial from interpreting the future price action. Is it a Doji candle, a hammer pin bar or shooting star?

Does it have a short or long shadow? How about the real body? Can we get any meaningful information from its size? Most of these things happen during the last moments in a daily candlestick. Takeaway from this section: Never expect or predict- always react! Such charts represent the frontier between investing and swing trading. Rarely swing traders look at daily timeframes, just as rare as investors look down at a daily chart.

A funny story about brokerages again, if I may. Recently read here in the last few yearsmost brokers around the world gave up on the Sunday candlestick.

As you may know already, for a couple of hours or so, trading takes place in New Zealand. Because of that early Forex trading supply and demand marking timeframe Zealand trading hours, it means Sunday for the rest of the world i. Europe, North America price action must reflect on the charts.

The time element plays an important role when trading with the Elliott Waves Theory. In fact, often traders using the time factor simply count the daily candlesticks to validate an entry or exit.

After all, traders have the responsibility of choosing what fits best to their trading style and analysis. Plenty of stores sell jeans, probably the same brand, and it is your choice from which store to buy. The same applies here, forex trading supply and demand marking timeframe. As mentioned earlier, a multiple timeframes analysis is a top-down analysis. It offers a clear picture of how the price action unfolds as economic news and events pour in.

More precisely, how the market digests the daily information, making it tradable or not. Again, brokers close the weekly price action at different times. How do you know which one is the relevant one? But the monthly chart is a blast.

So pure in the info provided that all the economic news and noise provided by the media outlets simply disappears. Historical data comes in yearly charts and sometimes has secular information. In the meantime, however, make sure you have GMT prices on your MT4 or whatever the trading platform used. With the steps above in mind, use the same strategy on all timeframes.

Trading Supply and Demand in Forex: Timing your entries

, time: 41:59How to Identify Supply and Demand | Action Forex

Wyckoff Trading Method – Wyckoff Phase D – The Price rises to Supply Edge. In the Wyckoff Phase B and Wyckoff Phase C, the Operators push the price to a Supply or Demand Edge. The purpose is to continue the previous trend. Of course, at least one of the Edges of the Trading Estimated Reading Time: 7 mins Aug 25, · A complete multiple timeframes analysis in Forex trading always starts with the bigger timeframe first. In other words, instead of a bottom-up analysis, a multiple timeframe analysis is a top/down one. Such an approach has multiple advantages, but the main one is that it offers a clear picture of the market. Any market! Jun 28, · Supply and Demand Multi Timeframe Indicator This indicator is a multiple timeframe version of indicator Supply and Demand. It allows you to analyze the graph, using the law of supply and demand in different time frames blogger.comted Reading Time: 2 mins

No comments:

Post a Comment