Aug 05, · Indian residents are allowed to transfer up to $, per year for purposes such as investment in foreign stocks or funds, education, maintenance of relatives and blogger.comted Reading Time: 4 mins 8 rows · Further TCS under section C (1G) (a) of the Income-tax Act, at the rate of 5% will be The Indo-Nepal Remittance facility provided by IME Forex ensures quick and easy transmission of funds from Indian territory to Nepal corridor. Well aware of the fact that India has been one of the key destination for majority of Nepali workers, IME Forex plans to serve them by allowing easy transfer of money to their families back at home

Transfer Money Overseas Online | Outward Money Transfer

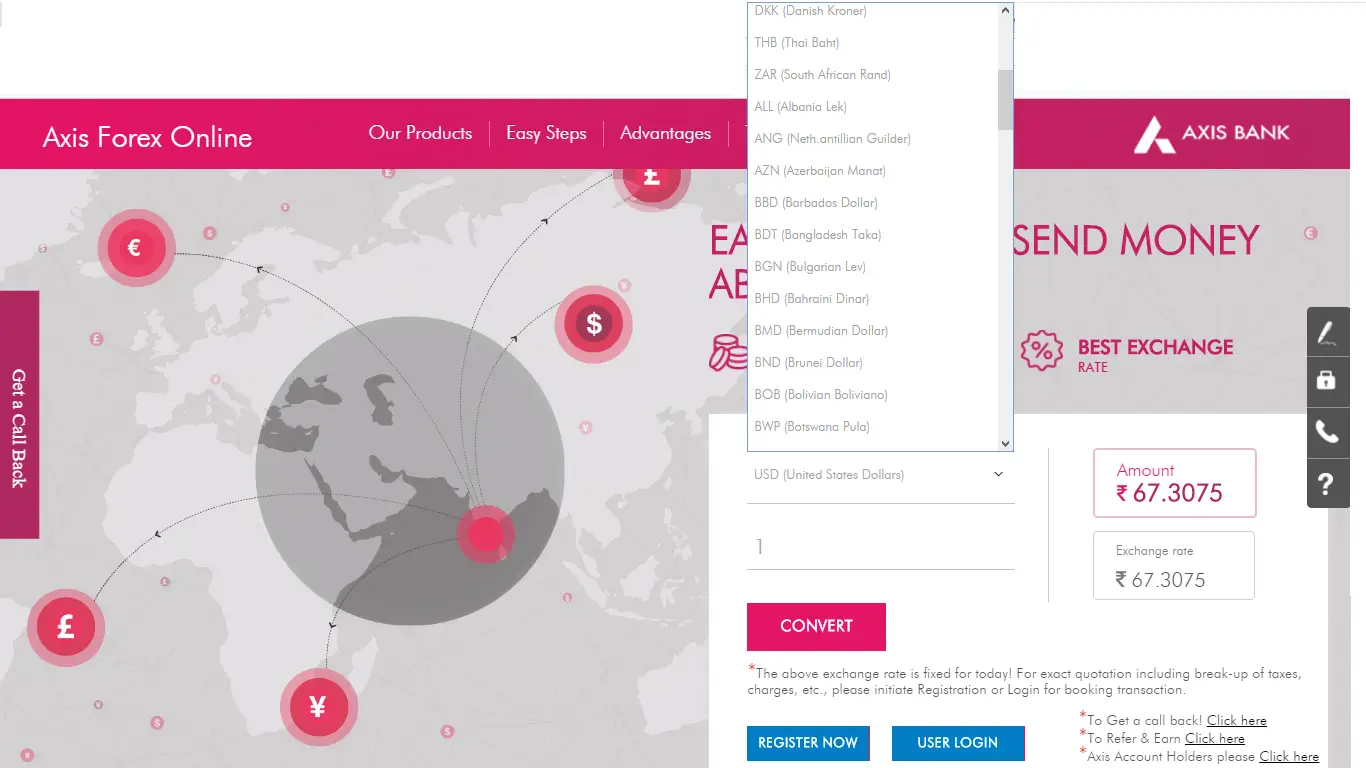

In Forex money transfer from india, just like on other commodities and services, a tax is levied on foreign exchange transactions too. With the implementation of the Good and Service Tax GST on July 1,the tax structure for forex services has changed. Contrary to what people imagine, the GST to be paid on forex is actually very less.

In forex money transfer from india, it would be just in the range of 0. For example, in a forex transaction worth Rs. As per the latest directive July 1, from the Government of India, the GST for foreign Exchange transactions is as follows. It is simply the value that is liable to be taxed. e, Rs. Assuming you are transacting the maximum volume of forex in Slab 1, i. Therefore the GST to be paid on a forex transaction worth Rs. Now that you know the GST breakup, rest easy knowing that it does not take much in the form of paying taxes even for large forex transactions.

Armed with this information, you can easily check if your bank or money changer is charging you unfairly by claiming higher tax amount. Also Read: How To Buy Forex Online In India. Would it be cheaper to buy foreign exchange from unlicensed forex dealers who are not charging any tax?

It may not be a good idea to buy forex from the so-called local forex agent near your home who can get you forex without charging any tax or giving a receipt for your transaction. Availing forex services from an unauthorized forex agent not approved by RBI is an offence and could land you in serious trouble.

Many such agents are usually involved in illegal activities like money laundering and distributing counterfeit currencies. Transacting with them might drag you into grave legal issues. Just Rs This unregulated black market may offer better exchange rates or waive tax on your forex transactions but the difference in amount saved compared to authorized forex dealers is marginal at best.

Tax on forex in really less at just 0. Better not to forex money transfer from india so much trouble to your doorstep for saving a few rupees.

How much tax would you have to actually pay on forex transactions up to Rs 25,? Since the minimum taxable value is Rs. How much tax on foreign exchange transactions between Rs. Also Read: 10 Things you should know before buying foreign exchange in India. Jun 19 18 by Subhash Sivamani In India, just like on other commodities and services, a tax is levied on foreign exchange transactions too, forex money transfer from india.

Slab 2 : Rs 1 lakh to Rs, forex money transfer from india. Slab 3 : More than Rs. The maximum GST for forex transactions is capped at Rs, forex money transfer from india. Also Read: How To Buy Forex Online In India Frequently Asked Questions 1. How much tax on currency exchange in India? Anywhere between Rs. How much foreign currency can I take out of India? Also Read: 10 Things you should know before buying foreign exchange in India Comments.

How To Exchange Foreign Currency In India — A Complete Guide ».

TransferWise (WISE) Money Transfer - How To Use TransferWise (2021)

, time: 17:35Forex Money Transfer From India

Aug 05, · Indian residents are allowed to transfer up to $, per year for purposes such as investment in foreign stocks or funds, education, maintenance of relatives and blogger.comted Reading Time: 4 mins Jun 19, · When performing foreign exchange service like currency exchange, money transfer abroad or buying a forex card, through a money changer or bank in India, the only tax you’ve to pay is the Goods & Services Tax (GST). As per the latest directive (July 1, ) from the Government of India, the GST for foreign Exchange transactions is as follows ;Estimated Reading Time: 5 mins 8 rows · Further TCS under section C (1G) (a) of the Income-tax Act, at the rate of 5% will be

No comments:

Post a Comment