Oct 29, · Gap trading strategies help traders capitalize on the gaps in charts caused by price fluctuations between sessions. Read on to discover more about the phenomenon of gaps, Estimated Reading Time: 6 mins Forex Gap Strategy Forex Gap Strategy — is an interesting trading system that utilizes one of the most disturbing phenomena of the Forex market — a weekly gap between the last Friday's close price and the current Monday's open price Jun 24, · Identifying weekend price gaps in Forex currency pairs and entering trades which aim for the gap to be filled before the end of Tuesday, has historically been a very simple and profitable trading strategy. This strategy can be traded using only the weekly time frame. Price gaps in the EUR/USD and USD/CHF currency pairs are usually filled blogger.com: Adam Lemon

Trading the Gap: What are Gaps & How to Trade Them?

Forex Gap Strategy — is an interesting trading system that utilizes one of the most disturbing phenomena of the Forex market — a weekly gap between the last Friday's close price and the current Monday's open price.

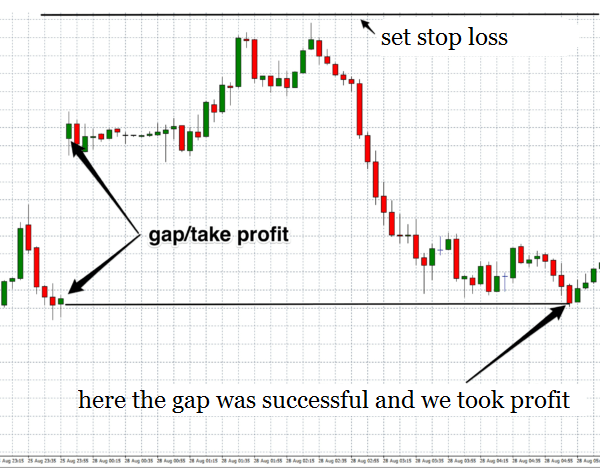

The gap itself takes its origin forex gap trading strategy the fact that the interbank currency market continues to react on the fundamental news during the weekend, opening on Monday at the level with the most liquidity. The offered strategy is based on the assumption that the gap is a result of speculations and the excess volatility, thus a position in the opposite direction should probably become profitable after a few days.

The last gap gives a wrong signal and yields a medium loss. The net total profit was 1, pips in 7 weeks — not that bad. Use this strategy at your own risk. com can't be responsible for any losses associated with using any strategy presented on the site.

It's not recommended to use this strategy on the real account without testing it on demo first. Do you have any suggestions or questions regarding this strategy? You can always discuss Forex Gap Strategy with the fellow Forex traders on forex gap trading strategy Trading Systems and Strategies forum.

MT4 Forex Brokers MT5 Forex Brokers PayPal Brokers WebMoney Brokers Oil Trading Brokers Gold Trading Brokers Muslim-Friendly Brokers Web Browser Platform Brokers with CFD Trading ECN Brokers Skrill Brokers Neteller Brokers Bitcoin FX Brokers Cryptocurrency Forex Brokers PAMM Forex Brokers Brokers for US Traders Scalping Forex Brokers Low Spread Brokers Zero Spread Brokers Low Deposit Forex Brokers Micro Forex Brokers With Cent Accounts High Leverage Forex Brokers cTrader Forex Forex gap trading strategy NinjaTrader Forex Brokers UK Forex Brokers ASIC Regulated Forex Brokers Swiss Forex Brokers Canadian Forex Brokers Spread Betting Brokers New Forex Brokers Search Brokers Interviews with Brokers Forex Broker Reviews.

Forex Books for Beginners General Market Books Trading Psychology Money Management Trading Strategy Advanced Forex Trading. Forex Forum Recommended Resources Forex Newsletter. What Is Forex? Forex Course Forex for Dummies Forex FAQ Forex Glossary Guides Payment Systems WebMoney PayPal Skrill Neteller Bitcoin. Contact Webmaster Forex Advertising Risk of Loss Terms of Service. Please disable AdBlock or whitelist EarnForex. Thank you! EarnForex Forex Tools Forex Strategies.

Features Regular trading with clear rules. No stop-loss hunting or premature hits. Statistically proven profit, forex gap trading strategy. You have to open position at the week's beginning and close it right before the end, forex gap trading strategy. How to Trade? Select a currency pair with a relatively high level of volatility, forex gap trading strategy. But other JPY-based pairs should work too. By the way, forex gap trading strategy, it's a good strategy to use on all major currency pairs at the same time.

When a new week starts look if there is a gap. A gap should be at least 5 times the average spread for the pair. Otherwise it can't be considered a real signal. If Monday's or late Sunday's if you trade from North or South America open is below the Friday's or early Saturday if you trade from Oceania or Eastern Asia close the gap is negative and you should open a Long position.

If Monday's open is above the Friday's close the gap is positive and you should open a Short position, forex gap trading strategy. Don't set a stop-loss or a take-profit level it's a rare occasion but stop-loss isn't recommended in this strategy. Right before the end of the weekly trading session e.

Morning Gap Trading - Simple Day Trading Strategy

, time: 10:04A Simple and Profitable Forex Gap Trading Strategy

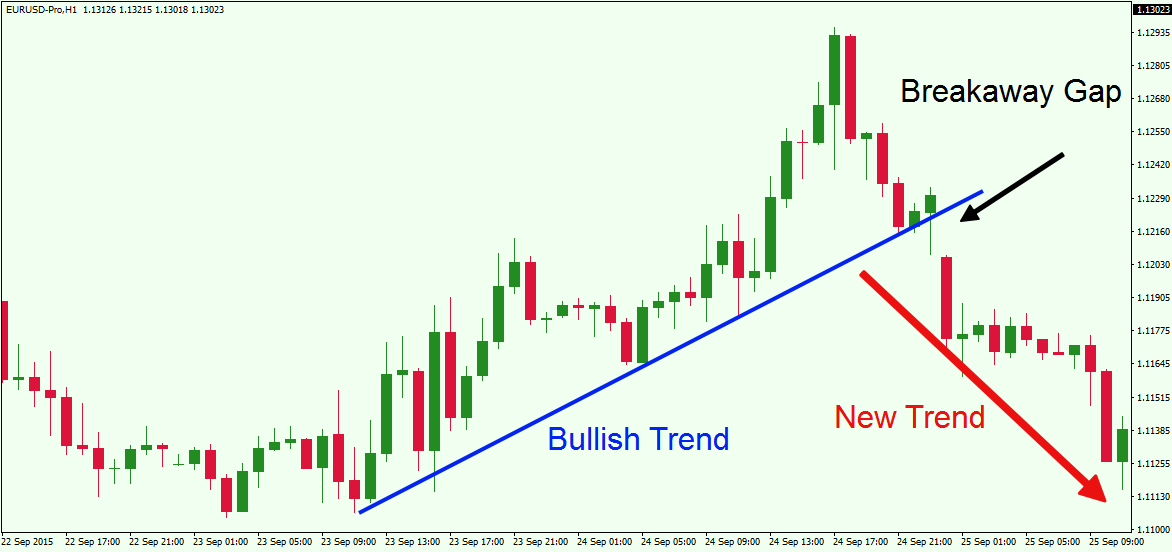

Trading the Gap Forex Trading Strategy “The price always fills the gap.” This is a common quotation among traders on the financial markets Forex Gap Trading Strategy The Forex gap trading strategy is a straightforward and exciting price action trading system that is focused on trading gaps that sometimes occur in the currency markets when the market opens again. One thing that you should have at the back of your mind is that gaps are visible once every blogger.comted Reading Time: 4 mins Gap Trading Strategy The forex weekend trading strategy that capitalises on gaps is about anticipating Sunday’s opening price will have returned to Friday’s closing price. The ‘gap’ is simply the price differential between the price when the traditional forex market closes on a Friday evening, and the price when it reopens on a Sunday

No comments:

Post a Comment