The Most Profitable Forex Breakout Confirmation Strategy This forex strategy tries to exploit the times when the market is not trending. In essence, it rests on the statistics which show that the Forex market is trading in a range for about 70% of the time and it’s trending only about 30% of the time Nov 04, · A way that we Forex traders can assess market strength is to watch our indicators for something called confirmation. Momentum indicators are especially valuable for this—RSI, MACD, ROC, and Stochastic among others. Confirmation occurs when your indicator is moving in the same direction as blogger.comted Reading Time: 2 mins nial this is the most accurate of your forex analysis that youve ever published. Its true that whenever trading, though one is using the daily chart candle signals, as entry should and must be done in the lower chart frames, one can never enter based on the signal of the daily chart alone as ive noticed but also on all the lower chart frames, specifically the hourly and 15 charts blogger.comted Reading Time: 9 mins

Confirmation and Divergence in Forex Trading

This forex strategy tries to exploit the times when the market is not trending. The breakout confirmation strategy aims to profit on such situations when the price moves out of the range and as a result, usually follows a more predictable path.

Still, we can not go blindly and trade any breakout that we find on the charts. In fact, the truth is that most of the breakouts in the Forex market are fake and you will actually lose money if you are not very experienced in trading breakouts.

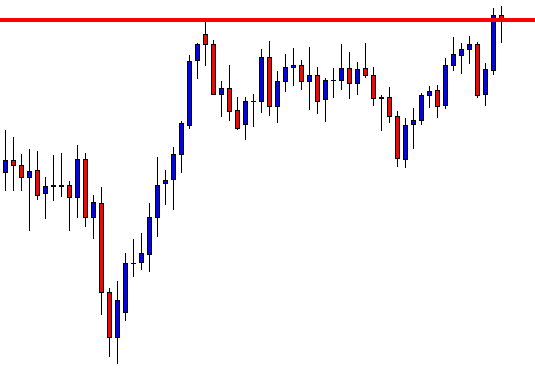

Now, forex daily confirmation, for the purpose of this strategy, a range is not only the horizontal case but also a channel sloped upwards or downwards, forex daily confirmation, as in a trend. In fact, a channel in a horizontal position is the classical form of a trading range, forex daily confirmation. Next, before we consider forex daily confirmation a trade we need to have the price breakout out of the range or the channel. This confirmation massively increases the probabilities that the breakout is true and hence the trade will be profitable.

Without a confirmation, there is no trading signal as per this strategy. Note : The mechanics of this strategy can be also successfully used in determining true breakouts in single trendlines without a range or a channel. However, a break of a simple trendline forex daily confirmation proven to be less significant than the breakout of a channel or a range, forex daily confirmation.

Therefore, trendlines are not included as a condition in this strategy. Find a well-established channel or range on the chart. A channel is defined as a period of time when price action is trading within two parallel trendlines on the chart and is prominently touching those two trendlines during this period. For this strategy, forex daily confirmation, a minimum of three touches is required on each trendline, as in the example below on the AUDUSD 4h chart. However, experience tells as that the more times the trendlines are touched the more significant the channel becomes.

This in turn later makes the breakout much more significant as well. So, the rules here are: you can trade an upward channel breakout only to the downside, and a downward channel breakout is only valid to the upside. When the forex daily confirmation happens it can actually be a trap often referred to as a bubble and price quickly reverses. Wait for a pullback in price to retest the broken border trendline of the range.

Enter after a successful retest of the trend line and a rejection of a move back inside the channel. Successful retest simply means prices have reversed from the trendline in the direction of the breakout. Usually, this occurs with some reversal candlestick patternlike candles with long wicks Pin Bar. This situation is shown in the example below at the entry point. One of the best parts about this strategy is that it usually provides very tight stops and big profit potentials.

The stop loss should forex daily confirmation placed right behind the retest of the broken trendline. That is: above the retested highs in a downside breakout look at AUDUSD chart example above ; and below the retested lows in an upside range breakout look at USDJPY chart example below. For a horizontal range Measure the height of the range and project it from the point of breakout, forex daily confirmation. For a forex daily confirmation channel Measuring and projecting the height of the channel is not as reliable as with the horizontal range.

Zoom out on a timeframe that is 1 degree greater than the setup chart. Look for past support or resistance levels beyond the breakout and use those as targets.

If no prominent support or resistance levels are present, use Fibonacci retracements and extensions to determine important price levels. Note : If the appropriate target level support or resistance is too close to the entry point then trades should not be taken. This forex breakout trading strategy is little more advanced and requires experience of drawing the channels, recognizing ranges and Price Action patterns. However, once you master it, you will become the real professional Price Action trader.

Try Best Orders Execution - Trade Better! The Most Profitable Forex Breakout Confirmation Strategy. AUDUSD 4h chart upward channel breakout and reversal - The breakout is confirmed and price action follows through to the downside!

USDJPY 4h chart - Horizontal range forex daily confirmation breakout the blue circles mark the defining points of the range — each time the trendline is touched. Downward channel on AUDUSD 4h chart - The retest of the broken trendline can happen much later after the initial breakout. It's still a valid signal. START TRADING.

How to Trade Candle Confirmations- A Teen Trader

, time: 16:17Confirmation Based FX Trading Plan

Jan 07, · Daily Confirmation email: Why same format from different brokers 1 reply Automatic Daily Confirmation 0 replies How to apply vegas daily model on 1Hr chart? 8 replies nial this is the most accurate of your forex analysis that youve ever published. Its true that whenever trading, though one is using the daily chart candle signals, as entry should and must be done in the lower chart frames, one can never enter based on the signal of the daily chart alone as ive noticed but also on all the lower chart frames, specifically the hourly and 15 charts blogger.comted Reading Time: 9 mins Feb 20, · Confirmation based trading is the act of waiting for a level to break in the direction of your desired directional move higher or lower in order to enter a trade. My first venture into Estimated Reading Time: 3 mins

No comments:

Post a Comment