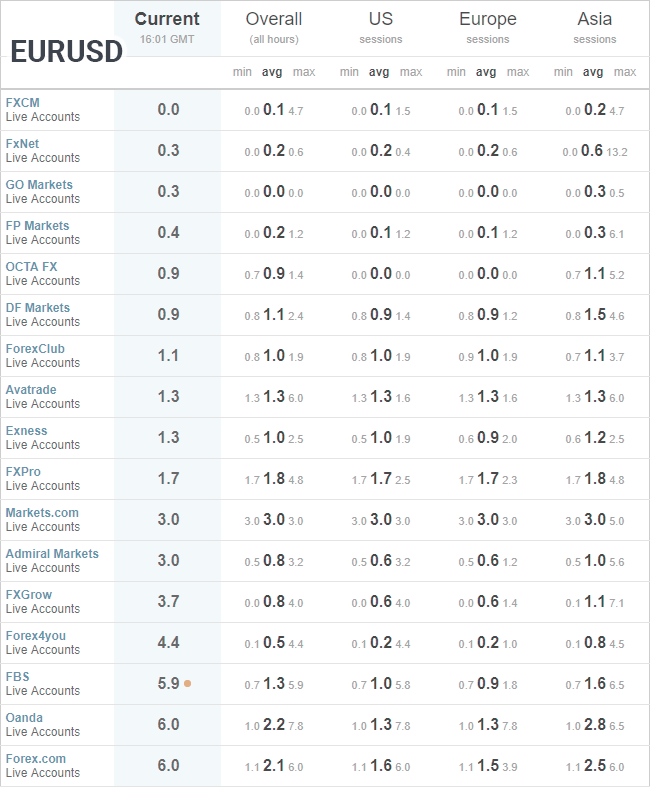

Jun 17, · Spreads for forex trading start at just pips, but can vary widely even for major currency pairs. For example, the EUR/USD pair trades at pips, but the USD/GBP pair trades with a spread of pips. Skilling is regulated by CySEC. You’ll need $ to open a new account and you can pay by credit card, debit card, or bank blogger.com: Michael Graw Spread. Spread means "spreading, widening, price range, net amount". And the spread in Forex is the price difference between the bid price (Bid) and the selling price (Ask, Offer) of the rate of the currency pair posted when performing Forex trading. For example, if the rate in US dollar / yen is " - 20", the spread is 5 sen Oct 25, · The EUR/USD has a spread or daily range of %, which makes it the pair with the lowest Spread. It is also the most traded pair in the Forex market. In

Low Spread Currency Pairs to Trade on Forex Market

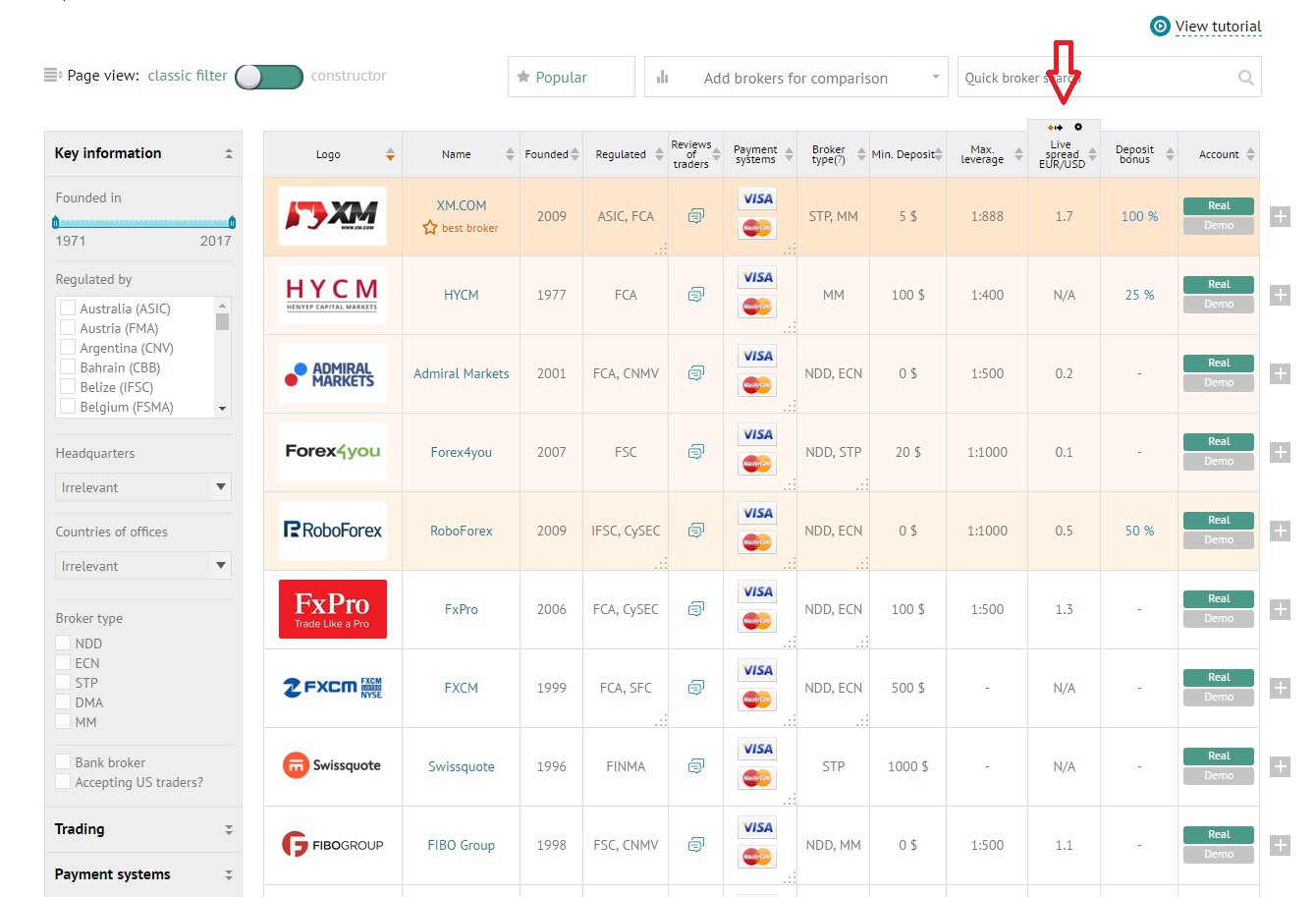

Recently, the competition in low spread has been overheating in Forex Industry, forex currency pairs with lowest spread, but we think that it is not the bottom line for the traders. At first glance, one might think that the low spread maybe very attractive. But there is lurking requote in there, and denial of contractual may occur, and variety of operational balance adjustment.

But we think that what is important is the balance in the service. It is not about a Forex trader with apparently good narrow spread, but what is important is though having a tight spread, is the service balance such as providing a stable trading environment without contract refusal or slippage. The GEMFOREX does not participate in the nonrealistic assertion of low spread competition. We aim for a comfortable balance service. Come and compare us to other companies, and feel the realistic spread and service balance that GEMFOREX provides.

Please check here for more information. GEMFOREX continues to pursue a comfortable environment for traders. For overseas Forex beginners and those considering forex for the first time overseas, our service is made safer and easier for you. Spread means "spreading, widening, price range, net amount". Forex currency pairs with lowest spread the spread in Forex is the price difference between the bid price Bid and the selling price Ask, Offer of the rate of the currency pair posted when performing Forex trading.

This will be the cost for you and the "commission fee" for Forex companies. Since spreads are set independently by each Forex trader, there is a difference between each Forex trader and it is generally said that the narrow spread the better. But at the risks such as of other services and costs, we recommend for you to judge considering the reliability and philosophy as a Forex trader.

Please see GEMFOREX spread which achieves realistic low spread and makes a difference by total service. Forex spread varies depending on the currency pair, and the magnitude of the spread is mainly determined by the trading volume and the method of trading. Spread is determined according to the number of orders at the time of trade buying and selling for each currency pair by the financial institution that provides rates to Forex companies.

In such a currency, even if the spread is set to small, there are many people who will trade, so it can be judged that there is no problem even if financial institutions offer small spread. Conversely, forex currency pairs with lowest spread, if you have a pair of currencies with a few trading volume, spreads are set widely.

Since Forex is a trade between currencies, if you sell something you buy something and if you buy something you will sell something. For example, if you buy a dollar yen, forex currency pairs with lowest spread, you will sell a yen and buy a dollar. If you buy euro, you sell the forex currency pairs with lowest spread and buy a dollar. This is because the market's key currency is against the dollar, trading through dollars. Of course it does not mean this forex currency pairs with lowest spread not change As a result, the spread is inevitably higher for the latter case when trading is established at one time and when it is not.

Spreads are determined from these factors. Of course the spread will change not only in the currency pair but also in the Forex company, and will fluctuate under the same conditions. Please refer to us in your dealings. HOME Trading Conditions Forex Currency pairs and spread. About GEMFOREX Currency pairs and Spread Recently, the competition in low spread has been overheating in Forex Industry, but we think that it is not the bottom line for the traders.

Nonparticipation to low spread competitions No requotes No hidden mark-ups Why is spread different for each currency pair? Trading volume Spread is determined according to the number of orders at the time of trade buying and selling for each currency pair by the financial institution that provides rates to Forex companies.

Trading method Since Forex is a trade between currencies, if you sell something you buy something and if you buy something you will sell something For example, if you buy a dollar yen, you will sell a yen and buy a dollar.

Micro account. All-In-One Account. No Spread Account.

Low Spread Forex Brokers - Top 3 Forex Brokers For Scalping 2020

, time: 15:235 Lowest Spread Forex Brokers in • Benzinga

Jun 17, · Spreads for forex trading start at just pips, but can vary widely even for major currency pairs. For example, the EUR/USD pair trades at pips, but the USD/GBP pair trades with a spread of pips. Skilling is regulated by CySEC. You’ll need $ to open a new account and you can pay by credit card, debit card, or bank blogger.com: Michael Graw Spread. Spread means "spreading, widening, price range, net amount". And the spread in Forex is the price difference between the bid price (Bid) and the selling price (Ask, Offer) of the rate of the currency pair posted when performing Forex trading. For example, if the rate in US dollar / yen is " - 20", the spread is 5 sen Oct 25, · The EUR/USD has a spread or daily range of %, which makes it the pair with the lowest Spread. It is also the most traded pair in the Forex market. In

No comments:

Post a Comment