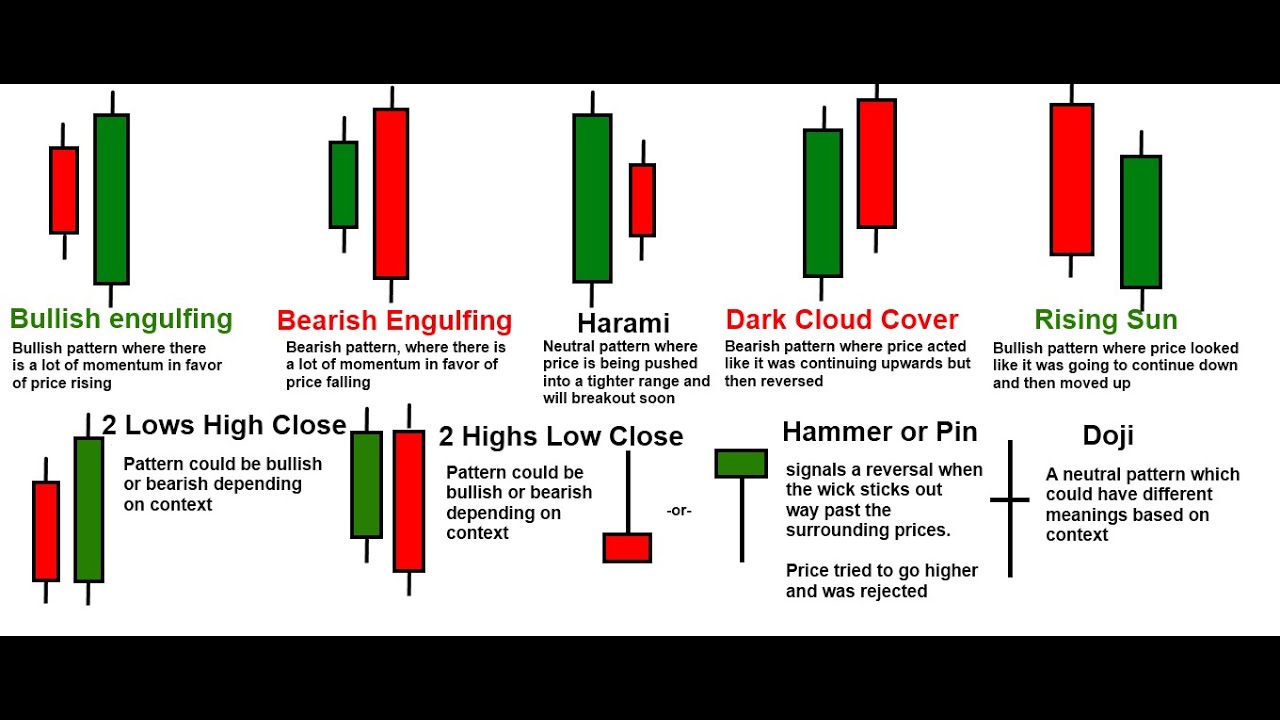

12/7/ · Candlestick formations and price patterns are used by traders as entry and exit points in the market. Forex candlesticks individually form candle formations, like the Author: David Bradfield 5/18/ · Forex candlestick patterns are a form of charting analysis used by forex traders to identify potential trading opportunities. This is based on historical price data and trends. When used in conjunction with other forms of technical and fundamental analysis, forex candlestick patterns can offer valuable insight into possible trend reversals, breakouts and continuations in the forex blogger.com Duration: 11 min 12/26/ · Forex Candlestick Patterns Bottom Line. Each candlestick pattern mentioned in this article signifies a different movement or action in the market. Forex traders who study these patterns, their shapes, compositions, and meanings for prices can make decisions regarding buying and selling as they see these patterns take blogger.comted Reading Time: 8 mins

Forex Candlestick Patterns: The Complete Guide

Are you searching for Japanese candlestick patterns and what are they? You are on the right place. In this exhaustive article you will learn how to identify the most common Forex candlestick patterns enabling you to enhance your trading strategy with this powerful and complete guide. The story of the candlestick patterns dates back to 18th Century Japan.

In early 18th Century Japan, when rice represented the medium of exchange as opposed to currency, feudal lords traded coupon receipts of rice stored in warehouses in Osaka, and eventually these exchanges evolved to become the first modern organized futures exchange Dojima Rice Exchangeyears before the birth of the Chicago Board of Trade CBOT.

In the s legendary Japanese rice trader Homma Munehisa — studied all aspects of rice trading from the fundamentals to market psychology, and subsequently dominated the Japanese rice markets and built a huge fortune.

This method was later picked up by the famed market technician Charles Dow aroundwho brought its awareness to Western Traders. More recently, Steve Nilson in the s researched and studied candlesticks, writing about them and in turn popularizing them via his classic book on the subject, Japanese Candlestick Charting Techniques.

Since their introduction in the West, forex candle patterns, candlestick charting techniques have become increasingly popular among technical analysts and they remain forex candle patterns wide use today among Forex traders.

Candlestick charts show the same Open, High, Low, and Close OHLC information as bar charts but they have a number of important advantages:. Note: While there is much we can see from the candlesticks, there is also much we cannot see. Candlesticks do not depict the sequence of events between the open and close, only the relationship between the open and close. We can easily see the high and low, but we cannot tell which came first. Forex candle patterns can offer valuable information on the relative positions of the open, high, low, and close, but the trading activity that forms a particular candlestick can vary.

Candlesticks are formed using the open, high, low and close of the bar, forex candle patterns. The forex candle patterns difference between candlestick patterns and bar patterns lies in the emphasis on the open and close, forex candle patterns. Bar charts do not treat the open and close with any special weighting.

If the market closed higher than it opened bullishthe real body is white or unfilled, with the opening price at the bottom of the real body and the closing price at the top. If the market closed lower than it opened bearishthe real body is black, with the opening price at the top and the closing price at the bottom. The longer the body, the more trend strength, and the shorter the body, forex candle patterns, more indecision, forex candle patterns.

A long shadow indicates failure for price to maintain its high or low and thus can signal trouble. Traders also prefer to trade in the direction of longer candlestick bodies. Long bodies indicate strong buying or selling pressure.

The longer the body, the stronger the buying or selling pressure. The buyers or sellers forex candle patterns stronger in mass and took control, forming the longer body. In contrast, short bodies suggest little buying or selling pressure and forex candle patterns more indecision, forex candle patterns.

Long white candlesticks represent bullish strength, forex candle patterns. When the close is a long way up from open, the long white candlestick is formed, indicating that bullish buyers have aggressively pushed the price up from open to close.

White candlesticks are generally bullish, but you have to consider them in relation to the big picture. If the market had declined, and is reaching a support level, a long white candlestick bouncing from support can mark a potential turning point. If the market had advanced, and is reaching a resistance level and traders are eager for a break, a long white candlestick breaking the resistance level is a potential forex candle patterns that the level has been clearly broken.

Long black candlesticks represent bearish strength. When the close is a long way down from open, the long black candlestick is formed, indicating that sellers aggressively pushed the price down from open to close, forex candle patterns. After a long advance to a critical resistance level, a long black candlestick can represent a turning point, where the sellers have launched a counter-attack.

Or, forex candle patterns, if the market had declined to a significant support, a long black candlestick breaking the support level signals that the Bears have breached this level. Sometimes a candlestick is all body and no shadow. It has no shadows extending from the top or bottom of the candle.

Forex candle patterns Japanese call them Marubozu, and they are difficult to find in a real market, forex candle patterns. A white marubozu candle has a long white body and is formed when the open equals the low and the close equals the high.

The white marubozu candle indicates that buyers controlled the price of the stock from the open to the close, and is considered very bullish. A black marubozu candle has a long black body and is formed when the open equals the high and the close equals the low.

A black marubozu indicates forex candle patterns sellers controlled the price from the open to close, and is considered very bearish. The pattern indicates indecision between buyers and sellers. The small real body whether white or black shows little movement from open to close, while the shadows indicate that both the bulls and bears were very active during the session. The session might have opened and closed with little change, but prices moved significantly higher or lower during the same period.

Neither buyers or sellers could gain the upper hand and the result is a deadlock, forex candle patterns. The price distance between the open and high forex candle patterns called the upper shadow. The price distance between the open forex candle patterns the low is called the lower shadow.

Candlesticks with long upper shadow and short lower shadow indicate that the buyers initially dominated the session, but then sellers later counterattacked and forced prices down from their highs, with the weak close creating the long upper shadow. Conversely, candlesticks with long lower shadows and short upper shadows indicate that sellers initially dominated the bar session, but then buyers later counterattacked and forced prices higher by forex candle patterns end.

Sometimes candlesticks lack a body, or retain forex candle patterns a very small one, and they are called doji. It is seen to lack a body because the opening and closing price are virtually equal.

The lengths of the upper and lower shadows can vary and the resulting candlestick looks like a cross, inverted cross, or plus sign. The doji represents indecision in the market. If the market is non-trending, the doji is not as significant, for non-trending or sideways markets are inherently indecisive.

If the doji forms forex candle patterns a trend, it is more significant, forex candle patterns, as it is a signal that the buyers of upward trend or sellers of downward trend are becoming exhausted, weak and losing conviction. The buyers or sellers have been tapped out.

The Doji witnessed in such a context can signal a ripe opportunity to enter early on in a potential trend reversal or trend correction, taking a trade in the opposite direction of the prior trend. A candlestick enacts the battle between Bulls Buyers and Bears sellers during the time frame of the candlestick. Each side is waging a mini tug-of-war within the candlestick to via for control, forex candle patterns, and the bodies and shadows of the candlestick give evidence of the struggle for power.

The bottom intra-session low of the candlestick represents the Bears in control, and the top inter-session high represents the Bulls in control, forex candle patterns. The closer the close is to the high, the closer the Bulls are to winning the engagement, and the closer the close is to the low, the closer the Bears are to winning. The above six formations are the generalized formations of candlesticks, and can help guide the trader along to easily spot the characteristics of Bullish and Bearish candlesticks.

Below I will attempt to illustrate some of the more specific candlestick patterns, grouping them into the Bullish and Bearish Formations. Explanation: We see the black body in a falling market suggesting that the bears are in command, then a small real body appears implying the incapacity of sellers to drive the market lower, and the strong white body of third day proves that bulls have taken over, forex candle patterns.

Explanation: Black real body while market is falling down may suggest that the bears are in command. Then a Doji appears showing the diminishing capacity of sellers to drive the market lower. All the above candlestick formations should act as confirmations of trend reversal, forex candle patterns, and you should be aware of the following three steps:.

Step 1 — Wait for the above patterns to appear during an established downtrend. An established downtrend is when the price is below the MA of D1 or H4. Step1 Alternate -Better yet, forex candle patterns, wait for the above pattern to appear during an established uptrend that is currently experiencing a bearish correction.

In other words, the price is below the Forex candle patterns of D1 and H4, forex candle patterns, and thus in an established downtrend, but recently the price has been charging above the MA of smaller time frames, such as H1 or M Step 2 — Confirm the potential for a trend reversal if the price is nearing key support levels.

These support levels would be defined by horizontal lines across swing highs, forex candle patterns, or pivot point resistance lines, or even Fibonacci retracement levels.

The strength of any bullish candlestick pattern is determined by the nearness to a support level. If the pattern appears in the middle of a trading range, it tends to have little significance. Step 3 — Confirm the reversal with any of the above Bullish Candlestick Patterns. Keep in mind that it is just as important to see the basic strong signs for Bears i.

Exit Signal: Place stop loss x pips above the next lower support level swing low, pivot or fib. Place take profit at next support level swing low, pivot or fib. Alternately, place a stop loss of pips, and a take profit of pips. Step 1 — Wait for the above patterns to appear during an established uptrend. An established uptrend is when price is above the MA of D1 or H4. Step1 Alternate — Better yet, forex candle patterns, wait for the above pattern to appear during an established forex candle patterns that is currently experiencing a bullish correction.

In other words, forex candle patterns, the price is below the MA of D1 and H4, and thus in an established downtrend, but recently the price has been charging above the MA of H1 or M Step 2 — Confirm the potential for a trend reversal if price forex candle patterns nearing key resistance levels defined by horizontal lines across swing highs, or pivot point resistance lines, or Fibonacci retracement levels. This is very important. The strength any candlestick pattern is determined by the nearness to a resistance level.

Step 3 — Confirm the reversal with any of the above patterns. Keep in mind that the exact patterns above do not have to mature. It is just as important to see strong signs for Bears such as long black candles, or candles with long lower shadows and weak signs of Bulls such as short white candles, forex candle patterns, or better yet, forex candle patterns, candles with a long upper shadow.

Exit Signal: Place stop loss x pips above the next resistance level forex candle patterns or fib. Place take profit at next support level pivot or fib. At first, it can be difficult to train your eye to see Candlestick patterns as they occur, and so it is practical to insert Candlestick pattern indicators that can be on the alert for these patterns 24 hours of the market. One of the indicators in this category did spot the 10 candlestick patterns illustrated above, making it one of the more interesting:.

Pattern Recognition. Note: you should not be basing your trades from the candle patterns themselves, but from the candlestick patterns in relation to the market context, along with confirmations from support and resistance.

Hopefully, you can now differentiate between long and short bodies, long and short shadows, forex candle patterns, and spot various types of Bullish and Bearish candlestick formations. Keep in mind that Candlestick Patterns are just one device in your arsenal of trading tools.

How To Trade Most Powerful Japanese Candlestick Patterns in Forex Trading

, time: 18:42▷ Forex Candlestick Patterns: Top 10 Patterns

11/12/ · All Bullish Candlestick Patterns. There are eight common Forex bullish candlestick patterns. All these patterns either suggest the beginning of a new uptrend or a continuation of a major uptrend. This is a list of all the bullish candlestick patterns in Forex:Estimated Reading Time: 5 mins 9/9/ · Medium. Morning Star. Three-candlestick, first long black body, second small real body, white or black, gapping lower to form a star. These two candlesticks define a basic star pattern. The third is a white candlestick that closes well into the first session’s black real 1/29/ · The Hanging Man forex candlestick pattern usually represents the notion that the trading day has experienced a substantial number of sell-offs. However, the price was still pushed up by buyers on the market. When faced with this pattern, forex traders can immediately deduce that the market's control is no longer in the hands of the bullish forces

No comments:

Post a Comment