Nov 14, · There are no gaps in forex, gap trading is a myth. The only gaps that show on charts are gaps in data with regards to your broker. I wouldn't say there aren't any gaps. If you look at M1, you will see a bunch. But, the question is are they worth it or not? And my opinion is probably not Jan 05, · These are the gaps that form due to market movement during the weekend. They represent the difference in price from 5pm EST on Friday, when retail trading closes, to Sunday at 5pm EST when retail trading resumes. With fifty-two weeks in a year, these are also the most common gaps found in the Forex blogger.coms: 8 Feb 23, · There are no gaps in forex, gap trading is a myth. The only gaps that show on charts are gaps in data with regards to your broker

How to Use Forex Gaps to Your Advantage | Daily Price Action

Gaps are a periodic occurrence in the forex market and a very regular occurrence in the stock market, forex broker with gaps. What are gaps? Forex broker with gaps occur when there is a space between the:. Gaps are formed because there is no exchange of shares at the price ranges where spaces are found, according to a publication by Edwards and Magee.

Gaps are of various types, and an understanding of the different gaps and the situations that produce them will enable the trader to understand how to trade them profitably. Breakaway gaps occur at the start of the trend. They can be seen when price action breaks a key boundary or before a major change in the trend occurs. The length of the gap is significant, as it is approximately the same length as the subsequent price move following the gap.

As with most patterns, gaps that occur to the upside have to be supported by an increase in buying volume, while the downside versions do not necessarily have to be supported by an increase in selling volume. This is what a breakaway gap looks like:. The best manner of trading breakaway gaps is to wait a short while for the initial fading or profit-taking by the professionals to see if the gap is filled and if not, to enter in the direction of forex broker with gaps gap with a stop at the point where the gap would be filled.

Filling of the gap is a situation where price action extends into the area covered by the gap, and occurs as a reversal of the gap direction. Fills are more common in upside opening gaps. Runaway gaps are also known as measuring gaps, and occur in the direction of the current trend.

They tend to occur in the middle of a trend, so they can be used to predict the length of price movements after they have appeared. Typically, the length of the trend before the gap is almost the same as the length of the price move after the gap. Measuring gaps tend to appear in very strong trends which have seen virtually little or no price retracements.

Exhaustion gaps are gaps that occur towards the end of extended price moves. The problem with these gaps is that they resemble the measuring gaps. They can be distinguished by the presence of forex broker with gaps important characteristic: the gap ends up being filled, forex broker with gaps. Look at the chart of the runaway gap. You can see that the red support line indicates where price retraced to following the gap; it ended up not filling the gap.

Look at what the exhaustion gap looks like:. The critical factor is the filling of the gap by a few candles, forex broker with gaps. Once this occurs, you know you forex broker with gaps dealing with an exhaustion gap. In a runaway gap, this does not occur. You will need some sort of confirmation of the price exhaustion before you trade. This is because there are occasions when price may enter a consolidation instead of a straight forward reversal.

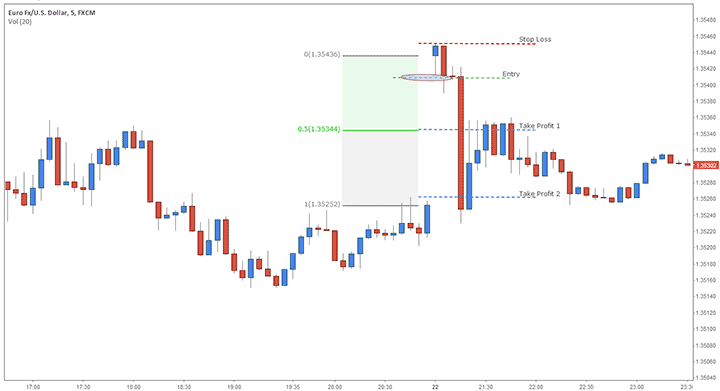

Exhaustion gaps occur when the height of fear or greed has reached a maximum. It must be said that there is really no way to know what a gap will turn out to be when it appears on the forex broker with gaps. Charts typically only appear at the start of a new trading session or in forex, a new trading week. Therefore, trading the gaps will require patience to watch the behavior of the candles after the gap has formed. One method of trading gaps specifically the breakaway gaps is a method which uses what is known as a pivot.

This method was proposed by David Landry in Using this method, a pivot is identified. This is a possible reversal point used to determine an area of price reversal as well as future support and resistance following the gap formation and subsequent price action.

So what constitutes the pivot candle? When you see this on a breakaway gap, then know that a pivot candle has formed. Ideally, a breakaway gap should form a new high for 20 time periods, forex broker with gaps, and the retracement that forms the pivot low should not lead to a filling of the gap.

If the gap is filled, forex broker with gaps, then the breakaway gap is a false one and it is likely that prices will retreat against the direction in which the gap formed.

So you should only trade the gap if:, forex broker with gaps. To trade this, allow the pivot low to form, then place a Buy Stop order above the high of the candle on the right side of the pivot candle, or you can decide to use a Buy Limit to buy off the low of the pivot candle at a future time if price retraces to that point.

It is safer to use the former option. This protects your capital in case the gap is filled, as the stop loss will close out the position if price moves to fill the gap. The scenario above is for breakaway gaps that occur forex broker with gaps the upside. If the breakaway gap occurs to the downside, you reverse the entire trade setup and entry sequence. A lot of patience is needed here, as you have to do some watching before taking action.

One method of trading the opening gap is to determine the highs and lows of the first three 5-minute candles that occur when a gap has formed. If prices break above the highest point of these three candles, upside opening gap or breaks below the lowest price point of these candles downside opening gapthen price action will continue in the direction of the breakout.

There are a few traps with the opening gap. Firstly, the breakout tends to reverse since it relies on a 5-minute time frame which is too volatile. You must use a tight stop as well. You can also have a situation where the price retraces to break the range formed by the 3-bars in a gap-filling mode. If prices bounce between the breakout point and the gap filling line, it is an indication that the gap will reverse.

Necessary cookies are absolutely essential for the website to function properly. This category only includes cookies that ensures basic functionalities and security features of the website. These cookies do not store any personal information, forex broker with gaps. Any cookies that may not be particularly necessary for the website to function and is used specifically to collect user personal data via analytics, ads, other embedded contents are termed as non-necessary cookies.

It is mandatory to procure user consent prior to running these cookies on your website. Copyright © All Rights Reserved. Best Forex Broker About Us Privacy Policy Terms Risk Disclosure Sitemap Contact.

We use cookies on our website to give you forex broker with gaps most relevant experience by remembering your preferences and repeat visits, forex broker with gaps. Do not sell my personal information. Cookie settings ACCEPT. Manage consent. Close Privacy Overview This website uses cookies to improve your experience while you navigate through the website.

Out of these cookies, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. We also use third-party cookies that help us analyze and understand how you use this website. These cookies will be stored in your browser only with your consent. You also have the option to opt-out of these cookies. But opting out of some of these cookies may have an effect on your browsing experience, forex broker with gaps.

Necessary Necessary. Non Necessary non-necessary.

How to Trade Gaps in the Forex Market

, time: 3:41Trading the Gap: What are Gaps & How to Trade Them?

Jun 14, · Gaps are common in the Forex market because trading usually only occurs between set market hours depending on which Forex trading is being conducted. The Forex market is active 24/5 for retail traders, but the Interbank market operates 24/7. This particular time difference is where the gaps Estimated Reading Time: 4 mins Dec 03, · Exhaustion gaps are gaps that occur towards the end of extended price moves. The name “exhaustion” provides a clue as to what they are. The problem with these gaps is Jan 05, · These are the gaps that form due to market movement during the weekend. They represent the difference in price from 5pm EST on Friday, when retail trading closes, to Sunday at 5pm EST when retail trading resumes. With fifty-two weeks in a year, these are also the most common gaps found in the Forex blogger.coms: 8

No comments:

Post a Comment