Consolidations (often known as ranges) are some of the most challenging market conditions people face when trading the forex markets. Usually consolidations begin after there has been a long trend present in the market. Traders using indicators like moving averages who may well have been in a small amount of profit from the trend tend to lose it Estimated Reading Time: 8 mins 9/29/ · The posted example was taken from 15min TF. You may use it as a filter together with your other indicators. General rule: No selling above and no buying below the silver channel. If you use it together with the voltychannel: Buy-signal as long as voltychannel is green A price consolidation is when after a trendy move by market, prices come to a flat period where prices don’t move much at all on either side. You can say that the forex market is taking a rest before it continues trending. Here’s an example of a market in a consolidation in a down trend:Estimated Reading Time: 8 mins

Consolidation — Indicators and Signals — TradingView

The good news is that there are ways to predict forex market consolidations and in here I will show you the 4 simple ways that will give you are greater chance of staying out consolidation forex market the market when it is in consolidation.

The bad news is that a predication is just a good guess…Sometimes you get it right and sometimes you get it wrong. What is price consolidation? You need volatility good price movement consolidation forex market order to make money in forex trading. That was a consolidation! And by the time those words consolidation forex market out of your mouth, consolidation forex market, you may have lost some of your account already!

The only way to tell the future in the case of forex consolidation forex market trading is understanding the kind of behavior the you have seen or witnessed in the past and based on that, make predictions good guess about the likely hood of that happening in the future. So in the same manner, by studying how price behaves and consolidations and what factors caused these consolidations in the past, we can reasonably assume that price is going to behave in the similar manner if those factors come in play again at some time in the future.

The first way to predict forex market consolidation is to identify and know the major price levels on your charts especially support and resistance levels. You know about support and resistance levels, consolidation forex market, right? One thing you may not realize is the fact that support and resistance levels are also notorious for forex market consolidation. And I got to add…not just ordinary consolidation forex market and resistance consolidation forex market but MAJOR support and resistance level!

When price head up to a major resistance level or a major support level, expect and anticipate the market to consolidate for a while. Let me consolidation forex market you an consolidation forex market is the weekly chart of NZDUSD. Just notice the major resistance level in circles, consolidation forex market. The second way to predict that the forex market may go into consolidation is when there are consolidation forex market events in the political or economic arena.

These days, major political events and economic news the fundamental factors happen frequently and as a result, when traders are just waiting for these consolidation forex market to happen, this can cause market consolidations. What Is Claimant Count? The claimant unemployment rate is the percentage change of people claiming for unemployment related benefits over the total number of full-time and part-time jobs available in the UK.

The claimant count measures the total number of people claiming for unemployment related benefits at Employment Services Office. Right now I wish I was on a holiday on a white sandy beach somewhere over the rainbow, way up high, and the dreams I dreamed of once in a lullaby…, consolidation forex market.

Have you ever seen how the forex market looks like during December as it nears the holiday period? Jame Wooley wrote an article about trading during December and he seems to have put the situation in a better perspective and he wrote in part and quote:. I have been trading the forex markets for a number of years now, and in my experience December is always the hardest month of the year to make money.

So why is this? As a result, consolidation forex market, you get a lot of slow-moving markets and a lot of trading sessions that are very quiet indeed, with very little price movement at all. To verify this for yourself, you only have to apply the average true range indicator to a daily chart of any of the main forex pairs, and see how it falls during December every single year.

So if you have a profitable trading strategy in place that is able to generate consistent profits during the rest of the year, you might want to consider reducing your profit targets or making changes to your strategy during the month of December because you could easily come unstuck in this quiet trading period. I myself tend to reduce my trading activity at the start of the month, and only take on the best high probability trades on the longer time frames, before stopping altogether once we get to around 15 December.

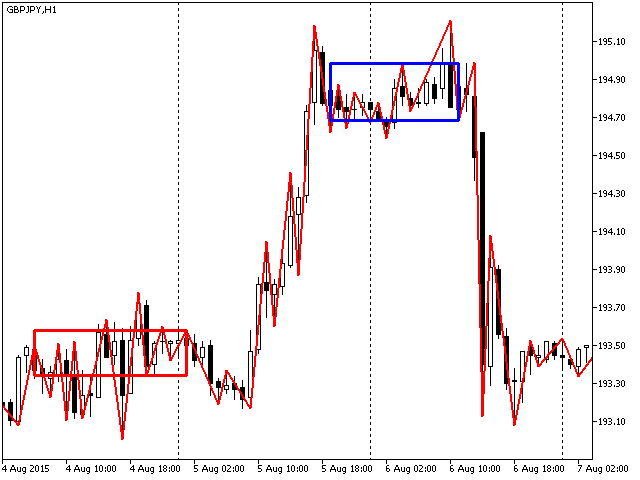

I will then slowly get back into the swing of things during the first or second full working week of the new year. It is your jobs as a forex trader to understand that trending market structure and once you start seeing price behaving differently from that, then start to question yourself if price is heading into a consolidation or not. In the chart above, notice that the swing highs and swing lows form the foundation for knowing consolidation forex market a market is trending and if the market is trending it will be making higher swing highs and higher swing lows in an uptrend and lower swing highs and lower lows in a downtrend.

Then on the middle section of the chart above, you see market starts to behave differently. It start making lower highs but not lower lows, consolidation forex market.

Market consolidations are so prevalent in smaller timeframes but if you switch to trading in larger timeframe like that daily, you can avoid those price consolidations found in the smaller timeframes like the 4hr, 1hr and below.

Click Here: Free Forex Trading Signals. But I did manage to catch a pips move on the retrace in GBPCHF and my trade still alive. Thanks for pointed me this post. Now i already read this post and i understand about consolidate in forex. I like price action trading and you educated me a lot, consolidation forex market. God bless you. How do you predict a forex market consolidation? Are there any ways or techniques to predict forex market consolidations or not?

Definition Of Price Consolidation What is price consolidation? You can say that the forex market is taking a rest before it continues trending.

So if the market is consolidating, consolidation forex market, it is very difficult for you to trade properly because: all trend trading strategies and systems will give you many false signals. if the consolidation forex market continues and you did not realize what is happening, you can loose a large chunk of your forex trading account just trying to make money during market consolidations.

So how does a forex trader know that a consolidation is going to happen? Answer: impossible. If every trader knew when consolidation was going to start, they will all be filthy rich.

This forms the basis of predicting forex market consolidations. RELATED How To Draw Trend Lines The Right Way In 2 Simple Steps. RELATED 2 Charts Reveal What Is The Trader's Action Zone. Prev Article Next Article. Thet Naung Soe. By the way. How many make money consolidation forex market brexit result?

Price Action: HOW to trade Consolidation PATTERNS (advanced trading lesson)

, time: 20:244 Ways To Predict Forex Market Consolidation (Learn How Here) | Forex Trading Strategies

9/4/ · Every consolidation in Forex charts will eventually end in a breakout in Forex trading (usually wild and fun!). When Forex traders identify a price consolidation, they usually anticipate a breakout to follow. A breakout occurs when prices break out of consolidation, penetrating the support (downward breakout) or resistance (upward breakout) blogger.comted Reading Time: 2 mins A price consolidation is when after a trendy move by market, prices come to a flat period where prices don’t move much at all on either side. You can say that the forex market is taking a rest before it continues trending. Here’s an example of a market in a consolidation in a down trend:Estimated Reading Time: 8 mins 4/29/ · Consolidation on the Forex market is a kind of sideways (flat) price movement on a currency pair chart. The borders of such price consolidation can fluctuate in the range from 20 to points (naturally, it depends on the chosen Forex timeframe). This movement contains at least three candlesticks (in a row).Reviews: 9

No comments:

Post a Comment