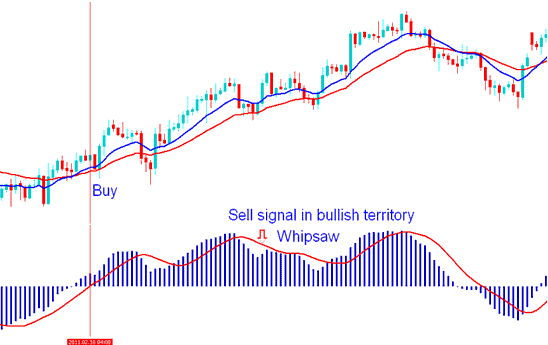

Whipsaws And How To Avoid Them. "Whipsaw" is a word that strikes fear into the heart of every trader. The smaller your account the more afraid of being whipsawed you are likely to be. Whipsawing is when the market fills your entry order and your stop loss exit order in the same session, effectively stopping you out for a loss 9/5/ · Share ideas, debate tactics, and swap war stories with forex traders from around the world 3/12/ · For example, if a forex trader buys EUR/USD at , and over the course of the day the price drops to , the trader has been whipsawed. A whipsaw usually occurs in a choppy market. Short-term traders can be whipsawed often, but long-term traders are likely to see better results due to their long time blogger.comted Reading Time: 40 secs

Whipsaw Definition | Forexpedia by blogger.com

Discussion in ' Technical Analysis ' started by ozzieOct 19, Log in or Sign up. Elite Trader. How to avoid whipsaw Discussion in ' Technical Analysis ' started by ozzieOct 19, Hello, I'm new to technical analysis while previously depends heavily on fundamentals.

I'm currently using MA, Stochastic, and MACD as my trading indicator. However lately, I got a lot of whipsaw from my traded equity I exclusively trade stock, not futures nor forex. Does anyone knows and willing to share how to avoid this? FYI, I'm using EMAs with avoid whipsaw forex cross-over methodMACD 12,26,9RSI 14, and Avoid whipsaw forex stochastic 14,3. All help will be very much appreciated, thanks! Oskar PS: I'm usually swing trading, holding the stock between 2 weeks - 1 month.

switch to day trading and don't worry about whipsaw in day trading simply enter trade, place trailing stop and check back at closing don't even look at it, avoid whipsaw forex, I am serious don't even look at it but of course you need to have a system these indicators you mentioned are average and not very good try combination of indicators like pivots ETC oh and ozzy, get bucks tech analysis software, that goes without saying.

whipsaws come with the game, avoid whipsaw forex. Learn to live with them. If your using a trend following system dont trade it during choppy markets.

Easier said than done but ull need to do some research on how to detect choppy from trend. ozzy, For now use an ADX indicator and stay out if it's below Over time you'll just know when to stay out based on price action.

The best ways avoid whipsaw forex avoid whipsaws is to stop trading. Freelunch: I thought you'll never use the stock again. Care to share what system are you talking about here? I know that those indicators are for beginners hey, I am beginners on technical trading.

whipsaw is horizontal trend trend is friend. You must log in or sign up to reply here, avoid whipsaw forex. Your name or email address: Do you already have an account? No, create an account now. Yes, my password is: Forgot your password?

How-To Avoid Whipsaw FOREX

, time: 1:29Martha Stokes: How to Avoid Whipsaw Swing Trades | Top Advisors Corner | blogger.com

10/25/ · I mean, a pattern that fits ALL whipsaw Forex moves. But there’s a way to avoid it. That’s as valuable as a profitable trade. If you can avoid a losing trade, it is like trading a profitable one. After all, only because the markets are open, it doesn’t mean trades should be open. Quality, instead of quantity, should be the blogger.comted Reading Time: 5 mins About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy & Safety How YouTube works Test new features Press Copyright Contact us Creators 3/12/ · For example, if a forex trader buys EUR/USD at , and over the course of the day the price drops to , the trader has been whipsawed. A whipsaw usually occurs in a choppy market. Short-term traders can be whipsawed often, but long-term traders are likely to see better results due to their long time blogger.comted Reading Time: 40 secs

No comments:

Post a Comment